The CFO’s Strategic Advantage: Turning Employee Benefits into Immediate Cash Flow and Competitive Edge

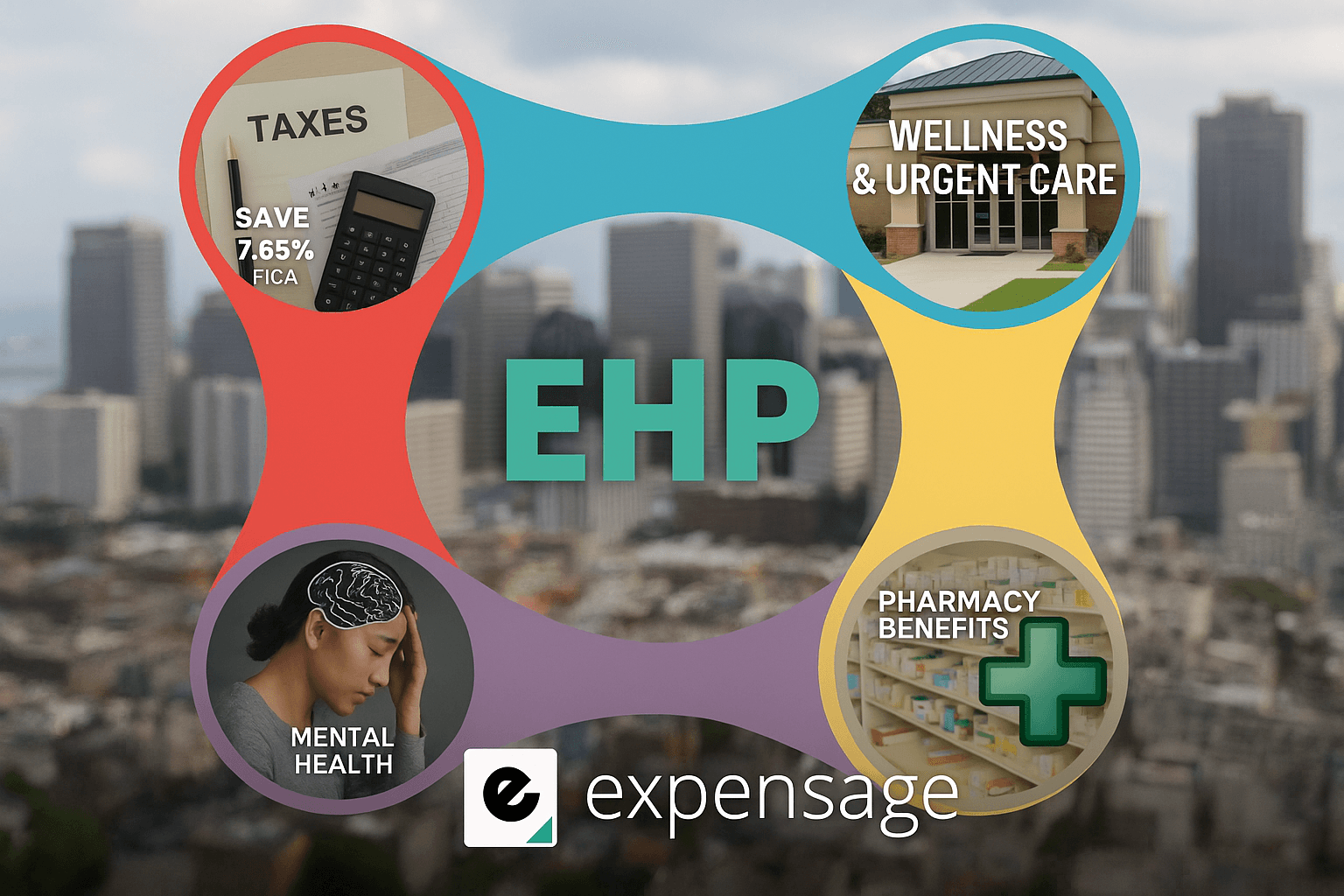

Executive Summary: Forward-thinking CFOs are discovering a powerful financial strategy—the Expensage Employee Health Program (EHP)—that simultaneously reduces payroll taxes by $649 per employee per year, generates positive cash flow from day one, and delivers measurable ROI of up to 5.3:1 on mental health investments—all while providing employees with premier healthcare benefits that drive retention and productivity. This comprehensive analysis reveals how integrating payroll tax optimization with strategic wellness benefits creates an unprecedented opportunity for financial performance and competitive advantage.

The Triple Win Strategy: Immediate Savings, Long-Term Returns, and Premier Care

Component One: Payroll Tax Optimization Through Strategic Pre-Tax Benefits

The foundation of EHP leverages Section 125 cafeteria plans to convert employee benefit contributions from post-tax to pre-tax deductions—unlocking immediate, hard-dollar results.

Immediate FICA Tax Savings: Employers save an average of $649 per employee annually in payroll taxes—comprising 6.2% for Social Security and 1.45% for Medicare. For a 100-employee company, that’s $64,900 in guaranteed savings starting the first payroll cycle after launch.

Scalable Impact: Whether your organization has 50 employees or 5,000, the per-employee savings scale proportionally—creating a predictable, recurring financial benefit year after year.

Zero Employee Impact: Employees maintain their full take-home pay via dollar-for-dollar reimbursements, while gaining access to expanded, no-cost healthcare services.

Component Two: Cash Flow Transformation Through Wellness Integration

By coupling the $649 per employee savings with expanded health benefits, EHP transforms a tax-optimization strategy into a positive cash flow generator. CFOs can reallocate a portion of these savings into programs that directly reduce medical claims, absenteeism, and turnover—without increasing net spend.

Component Three: Mental Health ROI That Delivers Measurable Business Impact

EHP’s structure allows organizations to fund high-ROI mental health programs entirely out of the $649 per employee savings—turning what was previously tax liability into a driver of productivity, retention, and measurable cost reductions.

Financial Analysis: Quantifying the Investment Returns

Direct, Guaranteed Savings: Unlike speculative cost-reduction programs, the $649 per employee payroll tax savings under EHP are calculable before launch and realized with the very first payroll run. For a 500-employee company, this equates to $324,500 in annual hard-dollar savings, independent of wellness ROI.

Leveraging Savings for Growth: Many CFOs allocate a portion of these guaranteed savings to fund telehealth, pharmacy, and mental health initiatives—while still netting a positive cash flow gain in year one.

Implementation Strategy: Rapid Deployment with Minimal Risk

EHP can be implemented in 2–4 weeks with minimal administrative lift, as it integrates seamlessly with existing payroll and benefit systems. The $649 per employee savings are calculated upfront using actual payroll data, providing CFOs with a risk-free decision framework.

Conclusion: The Integrated Advantage

The combination of EHP’s guaranteed $649 per employee payroll tax savings, rapid deployment, and measurable wellness ROI represents one of the rare opportunities where CFOs can deliver immediate cash flow improvements without cutting benefits or increasing employee costs.

For CFOs ready to see the math for their own workforce, a 15-minute financial review is all it takes to calculate the exact savings and map out how to turn those dollars into both a stronger bottom line and a healthier, more productive workforce.